RWA's Are the $46 Trillion Bridge

The most fascinating conversations I have these days aren't about the next meme coin or even AI tokens. They're about something less flashy but potentially more transformative: tokenizing real-world assets.

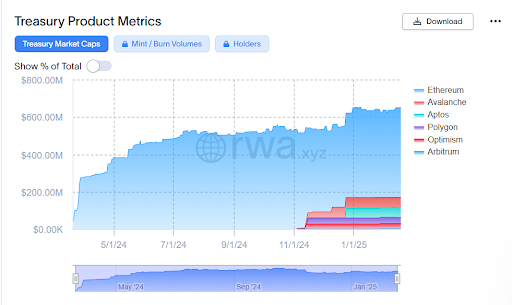

When BlackRock launched its BUIDL fund on Ethereum last year, it was a signal that the walls between traditional finance and blockchain technology are finally starting to fall. Today, that fund holds $650 million in tokenized assets. This is a small figure in BlackRock's world, but a massive vote of confidence for the entire RWA space.

The Case for Bringing Reality On-Chain

Cryptocurrency has always struggled with a fundamental contradiction. Volatility makes things exciting for traders but entirely impractical for everyday financial needs. Real World Assets (RWAs) break this trend by offering the efficiency of blockchain technology paired with the stability of assets that have intrinsic value.

Looking at the typical crypto market cycle, we see incredible rises followed by equally impressive corrections. While this might create wealth for some, it prevents the technology from fulfilling its broader potential. This is part of the reason why it's so common for people outside our industry to see crypto as speculative rather than functional.

RWAs can change this narrative. When you tokenize government bonds, real estate, or corporate debt, you're bringing existing value on-chain rather than creating value from nothing. The $38 billion RWA token market we see today is just the beginning. Industry analysts project it could reach $10-16 trillion by 2030, with more optimistic estimates from Northern Trust and HSBC suggesting as much as $46 trillion (predictions of 5-10% asset digitalization).

The Innovation Isn't Just What, But How

What makes the RWA space particularly compelling is the diversity of assets being tokenized and approaches being developed.

Centrifuge has focused on SME loans, tokenizing over 1,600 assets worth $677 million. Ondo Finance has built a $800 million ecosystem around tokenized U.S. Treasuries and yield-bearing stablecoins. MakerDAO, historically known for its stablecoin, now invests in government bonds.

Even more interesting are the emerging sectors. Several platforms are now tokenizing renewable energy assets. PowerDime alone plans to tokenize $250 million in clean energy projects, creating a fascinating overlap between blockchain technology and environmental sustainability.

The true innovation relates to how these tokens function. Smart contracts enable automatic dividend distribution, simplified voting rights, and seamless integration with existing DeFi protocols. These programmable features offer capabilities that traditional financial systems can't match.

The Challenges Are Substantial But Solvable

Despite the promise, significant challenges remain before RWAs can reach their full potential.

Regulatory frameworks are still evolving, with varying approaches across jurisdictions. The SEC hasn't provided clear guidance on chain-based RWAs, while the EU is developing regulations under MiCA. This uncertainty creates compliance challenges for both issuers and platforms.

Verifying that digital tokens are genuinely backed by the claimed real-world assets presents another challenge. Solutions require robust custody mechanisms, regular audits, and potentially legal frameworks that recognize on-chain ownership.

Interoperability between different blockchain networks also remains limited. RWA tokens exist on multiple chains like Ethereum, Solana, or Polkadot. Unfortunately, this creates liquidity fragmentation that needs to be addressed through better cross-chain solutions.

JuCoin as the Gateway to the RWA Economy

At JuCoin we are in an excellent position to become a gateway to this emerging RWA economy. We can mitigate a lot of the complexity that often prevents mainstream adoption of new crypto innovations. With our JuChain ecosystem, RWAs represent a particularly promising area of research and development for us. The seamless integration between our exchange and blockchain infrastructure creates unique opportunities for RWA projects. We can facilitate everything from simplified onboarding to enhanced liquidity and cross-platform functionality that standalone solutions simply cannot offer.

By implementing rigorous due diligence for RWA tokens, we can help users navigate quality investments while minimizing exposure to questionable projects. Integrating yield services allows users to earn stable returns through mechanisms that feel familiar to traditional finance users.

We've also made education a priority of our RWA strategy. Understanding concepts like fractional ownership, asset verification, and yield mechanisms can be challenging for newcomers. We will develop comprehensive learning resources to break down these complex topics into accessible formats, empowering users to make informed decisions as they explore this promising sector.

A Convergence of Financial Worlds

The future financial system won't be purely traditional or purely digital. At JuCoin we envision a hybrid approach that leverages the strengths of both worlds. RWAs represent a natural convergence point for the stability and legal frameworks of traditional assets and the efficiency and accessibility of blockchain technology.

For users, this means more options for wealth preservation alongside growth opportunities. For institutions, it offers a compliant on-ramp to digital markets. And for us, it creates opportunities to serve broader audiences with products that appeal beyond the crypto-native community.

The question isn't whether RWAs will transform markets, but how quickly and which platforms will lead the way.